Blockchain Technology In Finance

Starting with Blockchain Technology In Finance, this revolutionary concept is reshaping the landscape of financial transactions with its innovative approach and decentralized nature. As blockchain continues to gain traction in the finance industry, its impact is undeniable, paving the way for a more secure, efficient, and transparent financial ecosystem.

Overview of Blockchain Technology in Finance

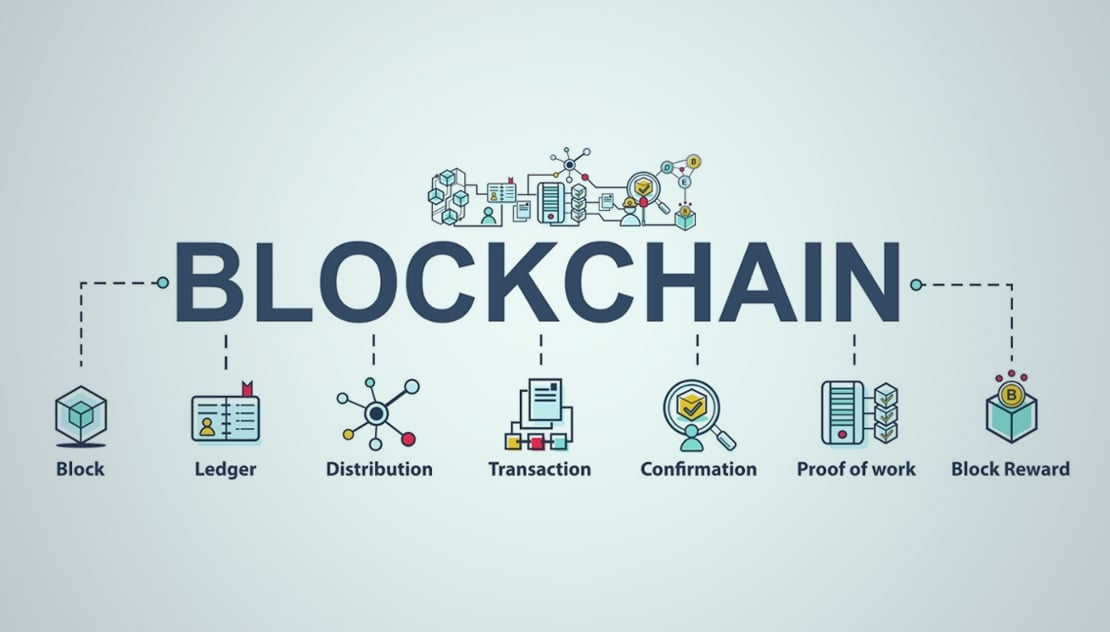

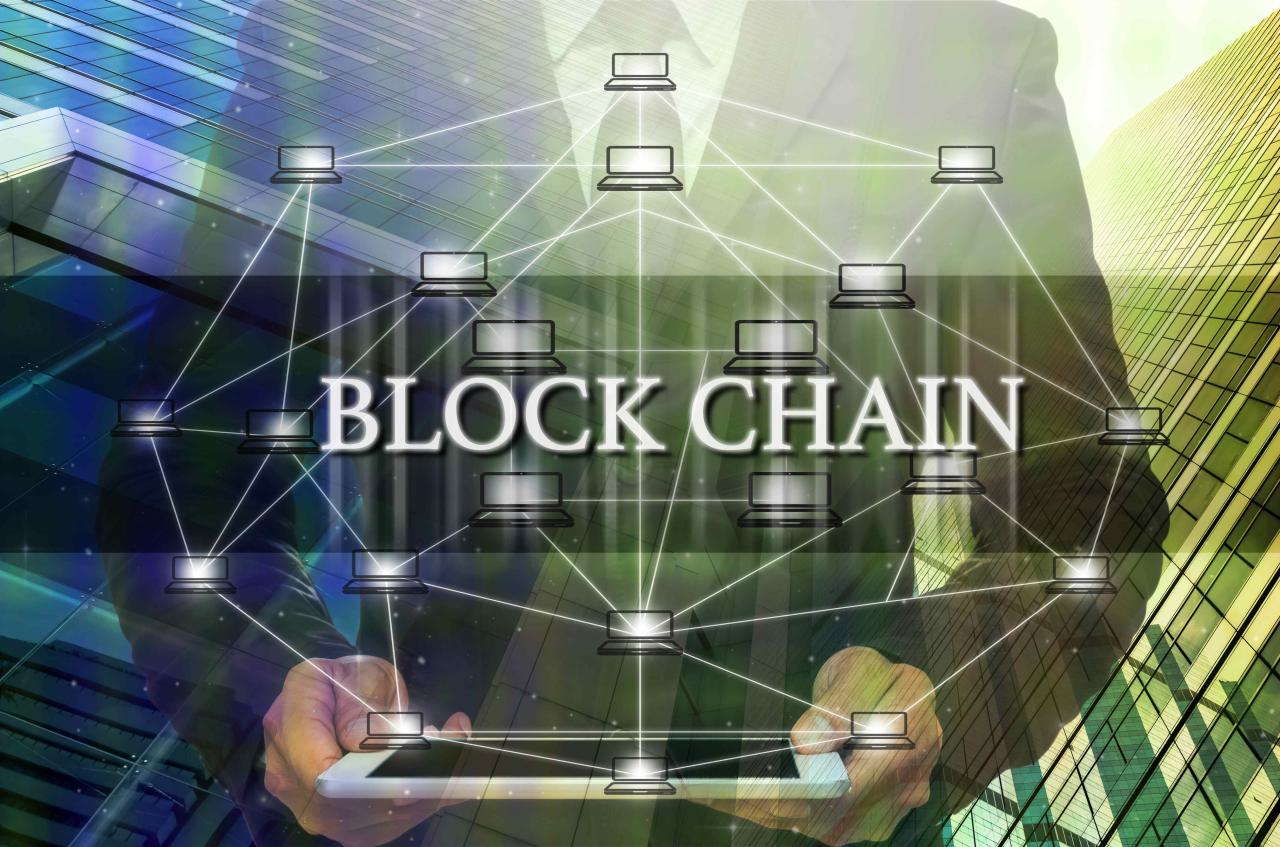

Blockchain technology has revolutionized the way transactions are conducted in the finance industry. It is essentially a decentralized and distributed digital ledger that records transactions across multiple computers in a secure and transparent manner. The data stored in blockchain is immutable, meaning it cannot be altered or deleted, providing a high level of security and trust in financial transactions.

Transforming the Finance Industry

Blockchain technology is transforming the finance industry by streamlining processes, reducing costs, and increasing efficiency. One of the key ways blockchain is making an impact is through faster and more secure cross-border payments. Traditional payment systems can be slow and costly, but blockchain enables near-instantaneous transactions with minimal fees. This can benefit individuals and businesses by eliminating intermediaries and reducing processing times.

- Increased transparency: Blockchain provides a transparent and tamper-proof record of transactions, which helps to prevent fraud and enhance trust among parties.

- Smart contracts: Blockchain allows for the creation of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This automates and enforces the execution of contracts, reducing the need for intermediaries.

- Cost savings: By cutting out intermediaries and streamlining processes, blockchain technology can lead to significant cost savings for financial institutions.

Use Cases of Blockchain in Finance

Blockchain technology has revolutionized the financial sector by providing innovative solutions to traditional processes. Let’s explore some key examples of how blockchain is transforming finance and enhancing security in transactions.

Improved Financial Processes

- Payments and Remittances: Blockchain enables faster and cheaper cross-border payments by eliminating intermediaries and reducing transaction fees.

- Trade Finance: Smart contracts on blockchain streamline trade finance processes, reducing paperwork and increasing transparency in transactions.

- Asset Management: Blockchain allows for the efficient tracking of asset ownership, reducing fraud and improving the overall management of assets.

Enhanced Security in Financial Transactions, Blockchain Technology In Finance

- Immutable Record-Keeping: Blockchain’s decentralized and tamper-proof ledger ensures that financial transactions are securely recorded and cannot be altered.

- Cryptographic Security: Transactions on the blockchain are encrypted, making it extremely difficult for unauthorized parties to access or manipulate sensitive financial data.

- Consensus Mechanisms: Blockchain’s consensus algorithms ensure that all participants in a transaction must agree on its validity, enhancing security and trust in financial transactions.

Role of Smart Contracts in Financial Operations

Blockchain-based smart contracts are self-executing contracts with the terms of the agreement directly written into code. They play a crucial role in automating and enforcing financial operations, such as:

- Loan Disbursements: Smart contracts can automate the disbursement of loans based on predefined conditions, ensuring transparency and efficiency in the lending process.

- Insurance Claims: Smart contracts can automatically trigger insurance claim payouts when specific conditions are met, speeding up the claims process and reducing the risk of fraud.

- Compliance and Regulatory Reporting: Smart contracts can help financial institutions in automating compliance processes and reporting, ensuring adherence to regulatory requirements.

Challenges and Limitations of Implementing Blockchain in Finance

Blockchain technology in finance faces several challenges and limitations that need to be addressed for successful implementation. These challenges include regulatory hurdles, scalability issues, and potential risks associated with blockchain adoption in financial systems.

Regulatory Challenges Faced by Blockchain Adoption in Finance

Regulatory challenges pose a significant barrier to the widespread adoption of blockchain technology in the financial sector. The lack of clear regulatory frameworks and guidelines can create uncertainty for financial institutions and hinder the implementation of blockchain solutions. Additionally, compliance with existing regulations, such as KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements, can be complex and time-consuming when integrating blockchain technology.

Scalability Issues Related to Blockchain Technology in Financial Systems

Scalability is a critical issue for blockchain technology, especially in the context of financial systems where transactions need to be processed quickly and efficiently. The current blockchain infrastructure may not be able to handle the high volume of transactions that occur in the financial industry, leading to delays and bottlenecks. As more users join the network, scalability becomes an even bigger concern that needs to be addressed to ensure the smooth operation of blockchain-based financial applications.

Potential Risks Associated with Blockchain Implementation in Finance

Implementing blockchain technology in finance comes with its own set of risks, including security vulnerabilities, smart contract bugs, and potential for fraud. The immutability of blockchain records means that any errors or malicious activities can be difficult to rectify once they are recorded on the blockchain. Moreover, the reliance on decentralized networks can expose financial institutions to new types of cyber threats and attacks, requiring robust security measures to protect sensitive financial data.

Future Trends and Innovations in Blockchain Technology for Finance: Blockchain Technology In Finance

Blockchain technology continues to evolve, offering new possibilities and innovations for the financial sector. Let’s explore some of the future trends shaping the industry.

Central Bank Digital Currencies (CBDCs)

Central banks around the world are exploring the potential of issuing their own digital currencies. CBDCs could revolutionize the way we transact and interact with money. These digital currencies would be backed by the central bank, providing a secure and efficient payment method. The implementation of CBDCs could streamline cross-border transactions, reduce costs, and enhance financial inclusion for underserved populations.

Decentralized Finance (DeFi)

Decentralized finance, or DeFi, is a rapidly growing sector that leverages blockchain technology to offer financial services without the need for traditional intermediaries. DeFi platforms enable peer-to-peer lending, borrowing, trading, and more, all through smart contracts on the blockchain. This innovation has the potential to disrupt traditional banking systems by providing greater accessibility, transparency, and efficiency in financial services. As DeFi continues to expand, it could reshape the way we think about finance and investment.

Blockchain Interoperability

Interoperability is a key focus for the future of blockchain technology in finance. As different blockchains continue to proliferate, the ability to communicate and transact seamlessly across multiple platforms becomes crucial. Projects working on blockchain interoperability aim to create a unified ecosystem where various networks can collaborate and share data securely. This development could open up new opportunities for cross-chain transactions, asset transfers, and collaboration between different blockchain projects.

Tokenization of Assets

Tokenization involves representing real-world assets as digital tokens on a blockchain. This trend has the potential to revolutionize the way we think about ownership and investment. By tokenizing assets such as real estate, stocks, or commodities, individuals can gain fractional ownership and access to traditionally illiquid assets. This innovation could democratize access to investment opportunities and create new markets for asset trading.

FAQ Summary

How does blockchain technology benefit the finance industry?

Blockchain technology provides transparency, security, and efficiency in financial transactions by eliminating intermediaries and enabling immutable record-keeping.

What are the main challenges faced in implementing blockchain in finance?

Regulatory hurdles, scalability issues, and potential risks are some of the key challenges encountered when integrating blockchain technology into financial systems.

What are some emerging trends in blockchain technology for financial services?

Central bank digital currencies (CBDCs) and decentralized finance (DeFi) are among the latest innovations reshaping the landscape of financial services through blockchain technology.